Overview

Many long-term investors use market movements as a guide to determining whether or not to make a purchase. If a company reports solid quarterly financial results, for instance, investors are more likely to bid up the price of its stock.

On the other hand, short-term traders often favor technical analysis, a different method. The theory behind this method is that trends tend to be repeated, so if a company’s stock has moved in a particular direction in the past, it will likely do so again. The future performance of a stock can be predicted by analyzing its past performance. Swing trading (where you trade every few days, weeks, or months) and the extremely risky strategy of day trading (where you buy and sell a stock on the same day) both favor the use of technical analysis.

Bạn đang xem: Best Books For Technical Analysis That You Should Know

Looking at both historical patterns (technical analysis) and current trends (fundamental analysis) is favored by some traders.

Mastering technical analysis to the point where you can use it for swing or day trading, which can result in large profits or losses, can be challenging. Due to its complexity and required level of expertise, technical analysis is not something we advise for everyone. However, if you are interested in learning more about technical analysis for trading, the following books are excellent places to start.

Best books for technical analysis

Technical Analysis of the Financial Markets by John J. Murphy

A detailed resource on technical analysis that explains the theory behind the practice and provides practical guidance for putting it to use. The information presented here is meant to fill a gap in knowledge for traders by providing a deeper understanding of technical analysis and familiarity with cutting-edge technological tools. The author helps the reader understand the art and science of reading charts and technical indicators in order to make informed trading decisions by explaining such concepts as intermarket relationships, stock rotation, and candlestick charting. Futures markets and the importance of technical analysis when working with advanced F&O instruments are also discussed. In other words, an all-inclusive manual on technical analysis for working traders.

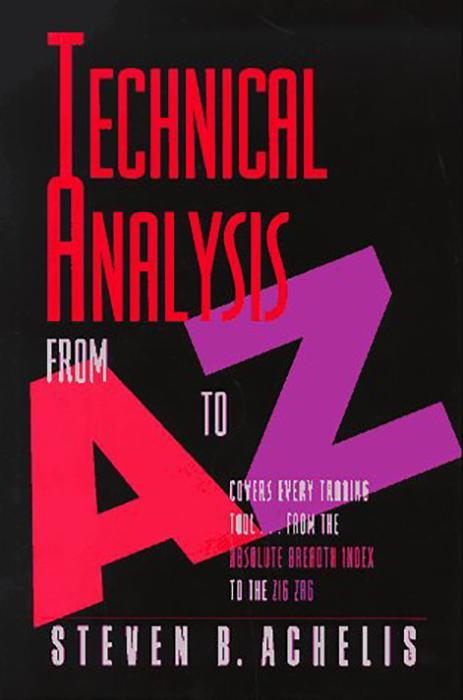

Technical Analysis from A to Z by B Steven Achelis

Technical analysis is presented in an approachable manner in the first section, making it a great read for those just getting started in the field. In the latter part of this work, you’ll find clear explanations of over a hundred technical indicators and a variety of widely-used chart patterns. This top technical analysis book is so helpful because of the author’s methodical approach to describing each indicator and illustrating it with applicable practical examples.

Technical Analysis by Charles D. Kirkpatrick II (Author), Julie R. Dahlquist (Author)

This book is the official companion to the Chartered Market Technician (CMT) program and is a comprehensive guide to technical analysis. Tested sentiment, momentum indicators, the flow of funds, seasonal effects, risk mitigation strategies, and testing systems are just some of the topics covered, along with numerous illustrations and real-world examples. Kagi, Renko, Ichimoku, and Clouds are just a few of the experimental indicators and pattern recognition tools discussed in this book, along with novel portfolio selection techniques that will keep readers abreast of the latest developments in the field. The book’s unique blend of theoretical and applied research into technical analysis makes it a valuable resource for both novice and seasoned traders.

Elliott Wave Principle by A.J. Frost, Robert R. Prechter Jr., Charles J. Collins (Foreword by)

The Elliott Wave principle, the basis of a great deal of analytical work, suggests that it is possible to study fluctuations in the stock market by looking for patterns that, when combined, represent more substantial wave-like movements. This book explains how readers can use their newfound knowledge of Elliott wave theory to accurately predict the direction of the stock market in the future. The authors argue that the scientific principle underlying this system is present in nature, art, mathematics, and the human body, and use it to analyze historical peaks and valleys. Almost theoretical work with real-world implications for the study of finance and the stock market.

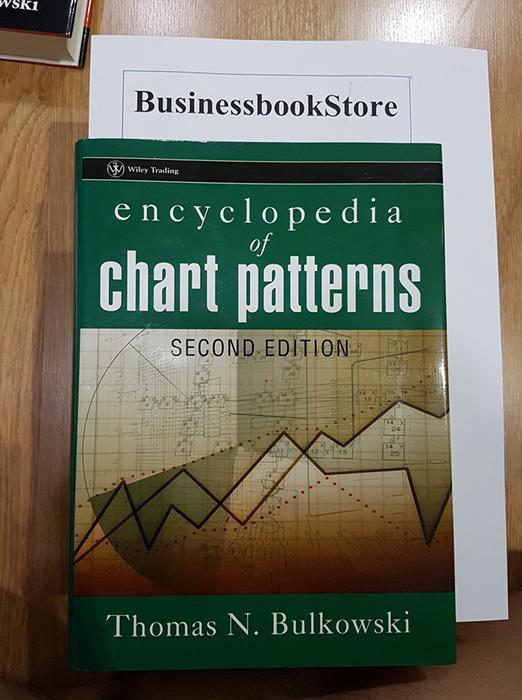

Encyclopedia of Chart Patterns by Thomas Bulkowski

Technical analysis makes use of a wide variety of chart patterns. Technical analysis predicts that an asset will behave in a certain way based on its historical tendency to behave in that way.

Bulkowski begins by outlining the basics of trading based on chart patterns, before delving into more than seventy different patterns that can be used in conjunction with technical analysis to determine when to buy and sell an asset. This level of specificity can aid you in deciding which trading patterns to use.

Technical Analysis of Stock Trends by Robert D. Edwards, John Magee

The topics discussed in “Technical Analysis of Stock Trends” are similar to those discussed in our other top picks. However, it also includes sections devoted to assisting you in making choices about your finances once you are ready to get started.

Stock selection, portfolio diversification, and allocating capital are just some of the topics covered.

Technical Analysis Explained by Martin Pring

The many aspects of technical analysis are discussed in detail in “Technical Analysis Explained,” and by the time you finish reading it, you should have a solid grasp of the subject as a whole.

Pring begins with the groundwork, outlining concepts like trend and pattern definitions. The author then delves deeply into the stock market, as a firm grasp of its inner workings is necessary for effective application of technical analysis. Day trading, swing trading, and technical analysis are not for novices. Pring also discusses more general topics, such as the impact of interest rates on the market and the psychology of trading.

Japanese Candlestick Charting Techniques by Steve Nison

Xem thêm : Best Magazines And Newspapers That You Should Know

Learn how to use Japanese Candlesticks, a technical analysis tool for charting and analyzing the price movement of securities, with the help of “Japanese Candlestick Charting Techniques,” a comprehensive and accessible guide.

Steve Nison, one of the world’s leading technical analysts with 30 years of experience or more, wrote the book.

The book provides a wealth of additional market and trading-related information via candlestick charting techniques.

This book is an excellent technical reference for anyone interested in the dynamics of the stock, options, futures, cryptocurrency, commodity, etc. markets.

Anyone interested in getting better at technical analysis should read this.

Technical Analysis Using Multiple Timeframes by Brian Shannon

American author, trader, and technical analyst Brian Shannon wrote “Technical Analysis Using Multiple Timeframes,” one of the best books on technical analysis.

The author provides a straightforward and easy-to-follow framework for evaluating financial markets and making risk-aware investment choices throughout the book.

The core of the book is an examination of how to recognize and anticipate trends across multiple timescales in order to capitalize on them.

Learn about market cycles, how to analyze them across various time frames, and apply sound principles of entry and exit as well as risk management in this comprehensive guide.

This book is a great introduction to the trading world and comes highly recommended from both newcomers and seasoned pros.

How to Make Money in Stocks by William J. O’Neil

William J. O’Neil is a stock trader, entrepreneur, and author, and his book “How to make money in stocks” is one of the best books to read if you want to learn about technical analysis.

The author uses the book to impart the wisdom and insights gleaned from years of practice as an investor.

In it, you’ll find a compilation of charts detailing the performance of winning stocks over the past few decades.

The notes also refer to the book’s accompanying charts to help readers better grasp the material.

The book also includes advice on when to cash out and when to keep going in the hopes of making a profit.

The Definitive Guide to Point and Figure by Jeremy Du Plessis

One of the earliest forms of technical analysis, point-and-figure charts have been around for quite some time. Choose this book as your one and only resource on the topic. It’s an in-depth look at the development and use of the method. As the “voice of the market,” the author argues persuasively that Point and Figure charts should be used.

Evidence-Based Technical Analysis: Applying the Scientific Method and Statistical Inference to Trading Signals David Aronson

The author here presents a more methodical approach to technical analysis. This book demonstrates how to analyze technical trading signals by combining a scientific approach with statistical testing. This book is probably not for the average reader because the techniques it describes require a high level of mathematical sophistication.

The Handbook Of Technical Analysis Mark Andrew Lim

This handbook was created to help students of financial technical analysis study for exams, but it has since become a standard resource for professional traders. In fact, sophisticated methods of financial management are the subject of their own chapter. In addition to popular technical methods, the book suggests what the authors believe to be more effective alternatives.

Technically Speaking: Tips and Strategies from 16 Top Traders Chris Wilkinson

Xem thêm : Best Free Online Courses With Certificates In South Africa

This one is essentially a compilation of interviews with sixteen successful traders who each share their own personal strategies. It ignores the abstract and goes straight to the source to reveal what really works. Previous readers have praised the book for its ability to distinguish between filler and actionable strategies, making it an excellent resource for those who want to cut to the chase and learn what really works.

The Art And Science Of Technical Analysis by Adam Grimes

An investor can learn everything about Technical Analysis from Adam Grimes’s The Art and Science of Technical Analysis.

An investor will find a wealth of new statistics, data, and chart patterns in the 2012 book.

The first half of the book is devoted to helping the reader get a good grasp of Technical Analysis, and the second half is devoted to explaining how markets work.

The latter features in-depth discussions of trading trends, as well as detailed analyses of specific trades supported by relevant statistics.

This groundbreaking book uses the available data effectively to reveal the inner workings of traders’ minds.

Getting Started in Technical Analysis by Jack D. Schwager

If you’re a beginner trader who wants to learn about technical analysis, this is the book for you.

In 1999, renowned trader Jack D. Schwager published this masterpiece aimed at novices who wish to become proficient in the technical aspects of trading.

Learn the basics of technical analysis by delving into things like chart patterns, trading ranges, price trends, and different pyramiding strategies in this comprehensive guide.

This book is well-liked by students because it is loaded with examples and illustrations drawn directly from the author’s own experience in the trading world.

FAQs

What is the best way to learn technical analysis?

If you want to master technical analysis, it’s best to start with the basics. (this can be done by reading up on technical analysis or enrolling in a class on the topic)

This information can then be put to use through rigorous backtesting and paper trading. (the paper trading platforms provide an excellent opportunity for this)

Which website is best for technical analysis?

There are a plethora of resources online that can be used for technical analysis.

Chartink, finology ticker, tradingview, trendlyne, etc. are just a few examples of websites that can be used for technical analysis.

Conclusion

If you were looking for something specific, I hope you found it here in this article.

Please share your thoughts with me now.

What book on technical analysis do you plan to read first?

Is this something you’ve never done before?

Please share your thoughts by replying to this post.

Nguồn: https://greeningschools.org

Danh mục: Blog